If you are salaried, run a business or regularly invest and borrow, the new PAN rules kicking in this December directly affect you. Under the PAN Card Changes Taking Effect in December 2025, if you delay PAN updates, verification or income tax return (ITR) filing, you risk your PAN becoming inoperative, facing a ₹5,000 penalty, higher TDS and even blocked refunds. PAN Card Changes Taking Effect in December 2025 do not mean just one new rule; the entire PAN ecosystem is being cleaned up and made fully digital. The government wants every PAN to be linked to a real, verified identity, properly connected with Aadhaar and matched with tax records. A small mistake or negligence from your side can now easily translate into fines, notices and financial hassles.

From December 2025, three fronts around PAN get much stricter PAN verification, PAN Aadhaar linking and timely ITR filing. Simply having a PAN card will no longer be enough; your details must match with Aadhaar, the status must show “operative”, and your ITR must be filed within the prescribed timelines. With the PAN Card Changes Taking Effect in December 2025, the risk of a ₹5,000 penalty for late ITR becomes more real because if your PAN turns inoperative or remains unlinked, you might not be able to file on time even if you want to. That delay can trigger late fees, interest and possibly future scrutiny. For those who depend on high‑value transactions, investments and loans, these changes are absolutely not optional.

PAN Card Changes

| Point | What Is Changing | From When | What Happens If You Ignore It |

|---|---|---|---|

| Mandatory PAN verification | PAN details must match Aadhaar and be digitally verified on the portal | From December 2025 | PAN may turn temporarily inactive, causing ITR and big transactions to get stuck |

| Final push for PAN–Aadhaar linking | Last window for pending cases and PAN issued with Aadhaar enrolment ID | Till 31 December 2025 | PAN can become inoperative, returns treated as invalid, refunds held back |

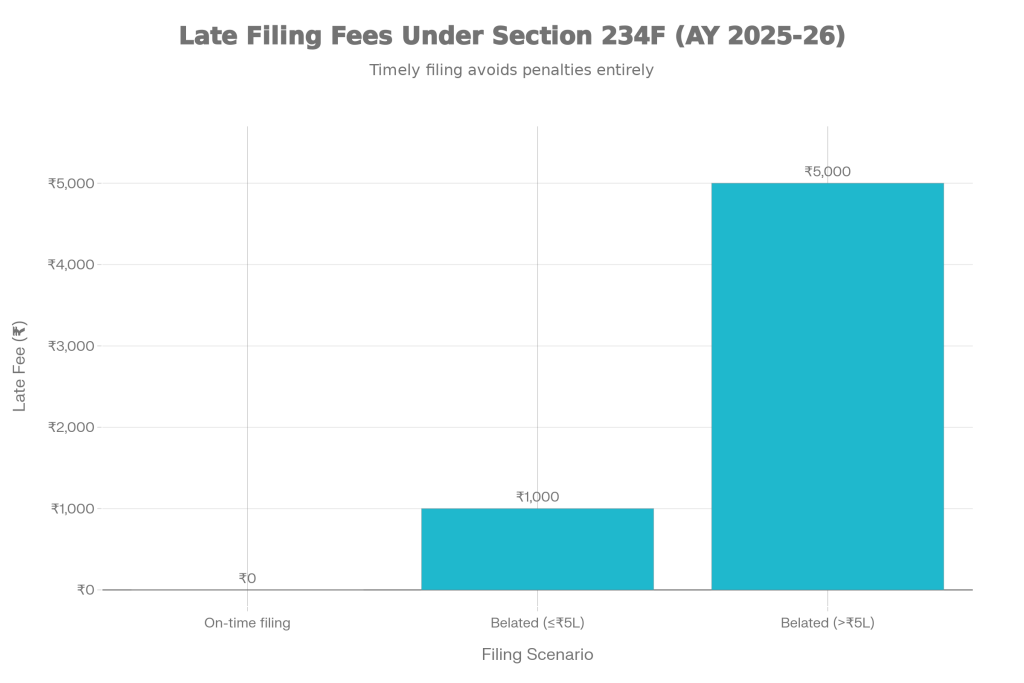

| ₹5,000 late ITR penalty | Late fee on ITR filed after due date | Applicable for AY 2025–26 | Income above ₹5 lakh may attract up to ₹5,000 penalty |

| PAN required for more transactions | PAN mandatory for more categories of high‑value online payments and investments | From December 2025 | Deals can be rejected or kept on hold if PAN is inactive or mismatched |

| Consequences of inoperative PAN | PAN moves to a “present but ineffective” status | After missing key deadlines | Higher TDS/TCS, form rejections, and stalled processing across services |

Why The Government Is Tightening PAN Rules

The government’s focus is clear to curb fake PANs, duplicate identities and benami transactions. For that, PAN is being deeply integrated with Aadhaar and digital KYC systems. With analytics and automated checks, mismatched, unlinked or suspicious PANs can be quickly identified and pushed into inoperative status. At the same time, keeping PAN data clean is vital for widening the tax base and plugging revenue leakages. When every major spends, investment and banking transaction flows through a verified PAN, it becomes harder to hide actual income or manipulate tax profiles. The PAN Card Changes Taking Effect in December 2025 are a key part of this larger strategy.

Who Will Be Most Affected by These Changes

The first group in the line of impact is regular ITR filers salaried employees, professionals, freelancers and business owners. For them, PAN is not just a card; it is the key to their entire tax and financial life. Once PAN becomes inoperative, everything from ITR filing and refunds to loans, credit cards and investments can get disrupted. Individuals who invest in mutual funds, shares, F&O or bonds also need to be extra careful about PAN status. With incomplete KYC or PAN errors, brokers and AMCs can block or restrict transactions. Small traders and GST‑registered dealers will feel it too, because TDS/TCS compliance, payments and departmental notices are all driven by PAN.

How The ₹5,000 Penalty Under Section 234F Actually Works

- Now let’s break down where this ₹5,000 penalty comes from. Under Section 234F of the Income Tax Act, if you file your ITR after the prescribed due date, a late fee becomes payable. Typically, for taxpayers with income up to ₹5 lakh, this fee is kept lower, while those with income above that limit may have to pay up to ₹5,000 for late filing.

- The real problem starts when your PAN itself is inoperative or the PAN–Aadhaar linking is not in order. In that case, you may want to file on time but are blocked by technical or compliance issues, and the delay still ends up attracting the late fee. With the PAN Card Changes Taking Effect in December 2025, failing to prepare in advance can easily push you into a situation where a small oversight costs you ₹5,000 plus interest.

Step‑By‑Step: How to Avoid The ₹5,000 Penalty

- The first step is to immediately check your PAN and Aadhaar status. Log in to the income‑tax e‑filing portal and verify whether PAN Aadhaar linking is complete and whether the PAN status clearly shows as “valid and operative”. If linking is pending or errors are visible, sort that out before anything else.

- The second step is for those who obtained PAN using an Aadhaar enrolment ID. You must update your actual Aadhaar number before 31 December 2025 to take advantage of the final window, often with relaxed or no penalty for this specific group. Missing this cut‑off can push your PAN straight into inoperative territory.

- Third, never push your ITR filing to the last week. As soon as your documents, Form 16, bank statements and investment proofs are ready, file your return in that month itself. This helps you avoid issues like slow portals, delayed OTPs or minor documentation errors that become major when deadlines are close.

Practical Checklist Before December 2025

- Check PAN Aadhaar linking status and raise a linking request if it is still pending.

- If there is any difference in name, date of birth or address between PAN and Aadhaar, correct it first on the relevant document and only then attempt linking again.

- If your PAN already shows as inoperative, start the process to make it operative again by paying any prescribed late fee and completing pending formalities.

- File your ITR for FY 2024–25 before the due date, and in any case before 31 December 2025, to avoid late fees under Section 234F.

- If you already have pending notices or tax demands, cross‑check your Form 26AS and AIS to ensure that PAN status and TDS/TCS entries are reflecting correctly.

PAN Card Update: Government Issues New Rules Every Cardholder Must Know

Long‑Term Benefits of Staying Compliant

- PAN Card Changes Taking Effect in December 2025 are not only about risk and penalties; they also bring long‑term advantages if you stay compliant. With clean PAN records proper KYC, correct linking and timely returns you will find loan approvals, credit cards, home loan top‑ups and large investments much easier to access.

- A neat tax profile also reduces the chances of unnecessary scrutiny or surveys. Refunds tend to come faster, banks and financial institutions trust your documentation more readily, and you can navigate the digital finance ecosystem without friction. In short, taking PAN seriously now pays off for years.

FAQs on PAN Card Changes

1. Will I still be able to link PAN and Aadhaar after December 2025?

In many cases, linking is allowed even after a deadline, but usually with late fees and the risk of your PAN remaining inoperative till compliance is done.

2. Will the ₹5,000 penalty apply if my income is below ₹5 lakh?

Generally, taxpayers with taxable income below ₹5 lakh face a lower late fee, while those above that threshold may be charged up to ₹5,000 for filing after the due date.

3. What exactly does inoperative PAN mean?

An inoperative PAN means that while your PAN number exists in the system, it is not treated as active for processing. This can lead to rejection or freezing of ITRs, refunds, KYC processes and high‑value transactions until you fix the underlying issues.

4. Is PAN–Aadhaar linking alone enough to stay safe?

No. You need three things in place: PAN–Aadhaar linking, correct and verified details on both, and timely ITR filing. The new framework stresses all three together, not just one.