f you’re an SC/ST woman looking to start a business, get skills training, or boost your income in 2025, government schemes supporting SC/ST women are game-changers. These programs offer low-interest loans, free training, and direct support, with over 1.26 lakh women entrepreneurs backed just under Stand-Up India by March 2025 alone. From tribal forest produce ventures to micro-loans for shops, they’ve helped folks like you turn ideas into steady earnings, creating real financial freedom in a tough world.

In 2025, government schemes supporting SC/ST women focus on real empowerment through easy online applications and quick approvals. With Budget 2025 allocating fresh funds like up to Rs 2 crore term loans for first-time SC/ST women entrepreneurs, access has never been smoother. Think collateral-free options via portals like myscheme.gov.in or NSTFDC, targeting everything from farming to e-commerce. Over 1.55 lakh SC/ST beneficiaries got aid via National SC-ST Hub by August 2025, proving these schemes deliver jobs and growth. Long-tail wins like “SC/ST women loan schemes online 2025” make applying straightforward, no middlemen needed. These initiatives aren’t just paperwork, they’re lifelines for rural and urban women alike, with success rates soaring as digital portals cut delays by 50%. Whether you’re in a village weaving baskets or dreaming of a city boutique, these schemes got your back.

7 Government Schemes Supporting SC/ST Women in 2025

| Scheme Name | Target Group | Key Benefits | Loan/Aid Amount | Application Portal/Agency |

|---|---|---|---|---|

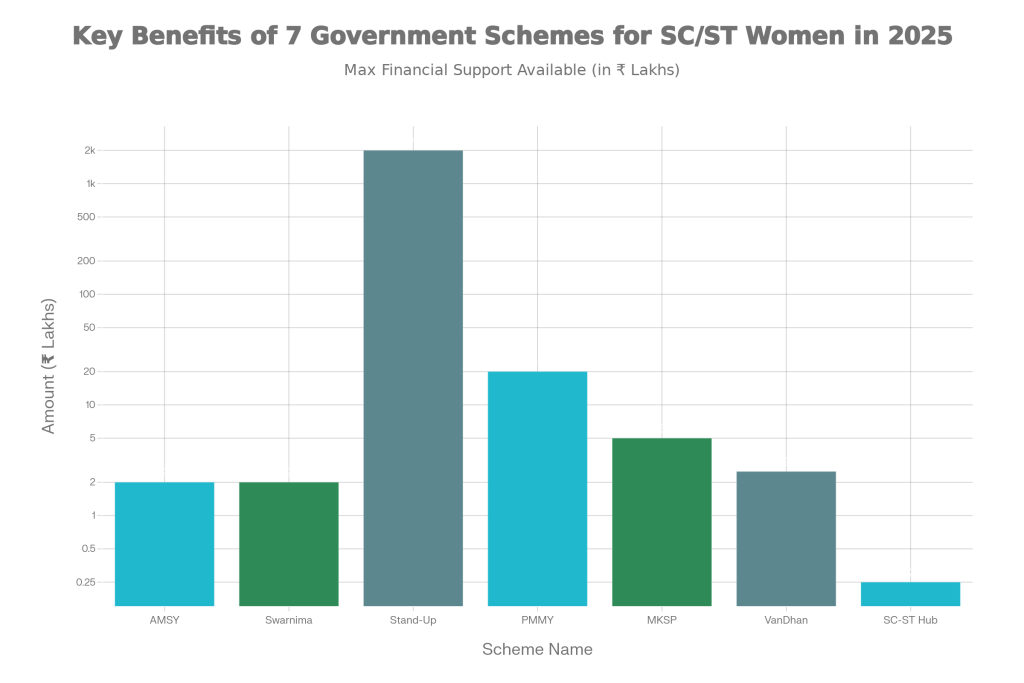

| Adivasi Mahila Sashaktikaran Yojana (AMSY) | ST Women | Loans for income-generating activities like piggery or crafts | Up to ₹2 lakh at 4% interest | NSTFDC via state channelizing agencies (nstfdc.tribal.gov.in) |

| New Swarnima Scheme | SC/OBC Women | Term loans for self-employment ventures | Up to ₹2 lakh at 5% interest | NBCFDC through State Channelising Agencies |

| Stand-Up India | SC/ST & Women Entrepreneurs | Loans for greenfield businesses in manufacturing/services | ₹10 lakh to ₹2 crore | Udyami Mitra Portal or banks (standupmitra.in) |

| Pradhan Mantri Mudra Yojana (PMMY) | Women Entrepreneurs incl. SC/ST | Collateral-free loans for micro-enterprises | Up to ₹20 lakh | mudra.org.in or participating banks |

| Mahila Kisan Sashaktikaran Pariyojana (MKSP) | Rural Women Farmers incl. SC/ST | Training, tools for sustainable farming | Financial support & capacity building | NRLM portals or state rural development depts |

| Van Dhan Vikas Kendra (under VDVY) | Tribal Women SHGs | Value addition for minor forest produce | Infrastructure, training, market linkages | TRIFED portal (trifed.tribal.gov.in) |

| National SC-ST Hub | SC/ST Women MSEs | E-commerce membership reimbursement, market access | Up to ₹25,000 reimbursement | scsthub.in or RaMAS portal |

Adivasi Mahila Sashaktikaran Yojana (AMSY)

Picture this: a tribal woman in Rajasthan starts a piggery farm with a small loan and now pulls in steady cash month after month. That’s AMSY in action, straight from NSTFDC for ST women aged 18-45. It funds projects like handicrafts, goat rearing, or small shops up to Rs 2 lakh at just 4% interest, with flexible 10-year repayment and only a tiny down payment from you. No collateral headaches, just straightforward support for income-boosting ideas that fit your skills and location.

What sets AMSY apart is its focus on practical, local ventures, helping women in remote areas escape poverty traps. Thousands have used it to launch poultry units or embroidery businesses, turning hobbies into full-time gigs. To apply, head straight to nstfdc.tribal.gov.in, select your state channelizing agency like a tribal development corporation, and upload essentials: Aadhaar, caste certificate, income proof, bank passbook, and a simple project outline. The process is mostly online now, with approvals in 2-4 weeks if docs are spot-on. Track everything digitally, and once sanctioned, funds hit your account fast. Real stories from Jharkhand show women earning Rs 15,000-20,000 monthly, enough to educate kids and build savings. If you’re an ST woman ready to hustle, this is your starting point, blending low risk with high reward potential.

New Swarnima Scheme For Women

- Ever thought about opening a beauty parlor, tailoring unit, or roadside eatery? New Swarnima makes it happen for SC women whose family income dips below Rs 3 lakh annually. Run by NBCFDC, it dishes out term loans up to Rs 2 lakh at a friendly 5% interest, tailored for self-employment dreams that don’t need fancy setups. It’s gained massive traction in 2025, with training tie-ups ensuring you launch strong.

- This scheme shines for its quick turnaround and women-only focus, prioritizing sectors like food processing or retail where SC women excel. Many graduates now run thriving ventures, employing neighbors and breaking income cycles. Getting started is simple: download the form from nbcfdc.nic.in, fill in your details, attach caste proof, Aadhaar, bank statements, and a basic business plan. Submit to your nearest State Channelising Agency, such as an SC corporation or cooperative bank, for review. Digital dashboards let you monitor progress, and repayments are structured to match your cash flow. Women who’ve scaled from Rs 50,000 loans to repeat funding swear by it, with some hitting Rs 1 lakh monthly turnover. Perfect for urban or semi-urban SC sisters eyeing independence.

Stand-Up India Scheme

Launched to ignite new businesses, Stand-Up India has pumped Rs 62,807 crore into 2.75 lakh accounts by late 2025, with 84% flowing to women including SC/ST folks. Revamped this year with Rs 2 crore ceilings, it targets greenfield projects in manufacturing, trading, or services, all collateral-free for eligible borrowers. Got an idea for a cafe, clinic, or tech repair shop? This is it. The beauty lies in the handholding free online training modules cover everything from pitching to accounting. Over 1.26 lakh SC/ST women have leaped in since 2022, many from villages now running city outlets. Register on standupmitra.in, grab your Udyam registration (free and instant), then approach partner banks like SBI or HDFC. Use digital signatures for paperless loans, from application to disbursal in under a month. Success tales from Gujarat highlight women scaling to multi-crore empires, creating dozens of jobs. In 2025’s competitive landscape, this scheme levels the playing field, making entrepreneurship accessible without upfront capital worries.

Pradhan Mantri Mudra Yojana (PMMY)

- PMMY isn’t hype, it’s 68% women-led success, with 5.46 crore loans in 2024-25 pushing micro-enterprises forward. SC/ST women priority gets you Shishu (up to Rs 50k), Kishore (Rs 5 lakh), or Tarun (Rs 10 lakh+), zero collateral for kirana stores, food carts, or salons. It’s the go-to for quick starts.

- What makes it tick? Seamless integration with banks nationwide, plus priority for marginalized groups. Village women have flipped tiny loans into chains, employing families. Hit mudra.org.in, pick a lender, upload KYC docs and a one-page plan, and watch funds arrive in days. No guarantors, just your drive. By 2025, it’s empowered millions, with many upgrading categories for bigger growth, turning side hustles into legacies.

Mahila Kisan Sashaktikaran Pariyojana (MKSP)

- Rural SC/ST women farmers, listen up: MKSP under NRLM equips you with organic farming know-how, drip irrigation kits, and market hooks through SHGs, zeroing in on landless or smallholder families. Thousands of groups accessed seeds and tools this year, boosting yields by 30%.

- It goes beyond cash, fostering collectives for bargaining power and sustainability training. Women in Bihar and Odisha report doubled incomes from millets or veggies. Dive into myscheme.gov.in for state NRLM links, submit SHG profiles with land docs online. Training camps follow approval, building skills for life. This scheme sustains communities, proving farming can be profitable and empowering.

Van Dhan Vikas Kendra Yojana

Tribal women turning mahua flowers into soap or honey into brands? Van Dhan builds SHGs for minor forest produce processing under TRIFED, with over 50,000 centers by 2025 offering kits, FSSAI nods, and Tribes India outlets. It’s community-driven, linking forests to markets seamlessly. Rajasthan groups rake in lakhs yearly from value-added goods. Form or join an SHG, register on trifed.tribal.gov.in, submit plans for funding and mentorship. Hands-on training ensures quality, fueling economic booms in tribal belts.

Land Registration Alert: New Rules for Property Registered in a Spouse’s Name

National Sc-St Hub

- Dreaming of GeM or Amazon without fees? National SC-ST Hub refunds up to Rs 25k for e-commerce joins, aiding 1.55 lakh SC/ST women MSEs by mid-2025, plus marketing boosts.

- It opens procurement doors for crafts or products. Login to scsthub.in with Udyam ID, upload bills via CSCs for swift payouts. Women artisans now sell nationwide, shattering isolation.

- These government schemes supporting SC/ST women in 2025 reshape futures, from PMMY’s 5 crore loans to Stand-Up’s Rs 43k crore women aid. Start at myscheme.gov.in, arm yourself with Aadhaar and certificates. State help accelerates, quotas rise this cycle. Apply now, build tomorrow.

FAQs on 7 Government Schemes Supporting SC/ST Women in 2025

Who qualifies for government schemes supporting SC/ST women in 2025?

SC/ST women 18-55 with incomes under limits like Rs 3 lakh for Swarnima. Need caste and income proofs.

How long does online application take for these schemes?

15-30 days on portals like standupmitra.in with full docs. Track digitally.

Can I combine multiple government schemes supporting SC/ST women?

No, rules prevent double benefits.

What documents for SC/ST women loan schemes online 2025?

Aadhaar, caste cert, bank details, project plan, Udyam ID.