If you work in India’s unorganised sector, the ₹3000 monthly pension scheme for workers is the simplest way to secure a steady income after 60 without market risks or complicated paperwork. It guarantees a fixed ₹3,000 per month for life from age 60, matches your monthly contributions rupee-for-rupee during your working years, and adds a family pension of 50% for your spouse if you pass away after pension starts. You enroll once, contribute regularly through auto-debit, and unlock a predictable retirement income backed by an institutional framework that includes on-ground support at Common Service Centres and payout management by the designated fund manager.

The ₹3000 monthly pension scheme for workers is designed specifically for informal earners street vendors, construction labourers, domestic workers, farm workers, drivers, gig and platform workers, and similar roles without EPF or employer-backed pensions. Eligibility is straightforward: age between 18 and 40, monthly income up to ₹15,000, not a taxpayer, and not covered by EPF, ESIC, or NPS. You pay a small, age-based monthly contribution; the central government contributes the same amount; and from age 60, you receive ₹3,000 per month for life. The scheme also provides a 50% family pension to the surviving spouse after vesting, plus flexible exit and revival features that reflect the reality of irregular incomes in the unorganised workforce.

₹3000 Monthly Pension Approved

| Key Item | Details |

|---|---|

| Scheme Name | Pradhan Mantri Shram Yogi Maandhan (PM-SYM) |

| Target Group | Unorganised workers, monthly income ≤ ₹15,000, age 18–40 |

| Assured Pension | ₹3,000 per month from age 60, lifelong |

| Government Support | Equal monthly matching contribution (50:50) until 60 |

| Family Pension | 50% of subscriber’s pension to surviving spouse after vesting |

| Enrollment Channels | CSCs (Common Service Centres) and the Maandhan portal |

| Contribution Range | About ₹55–₹200 per month based on entry age |

| Documents Needed | Aadhaar, savings/Jan Dhan account with IFSC, mobile number |

| Flexibility | Exit options, revival window up to 3 years, statements, claim status |

| Administration | Pension fund management and CSC facilitation network |

The ₹3000 monthly pension scheme for workers is a practical, reliable bridge from uncertain earnings today to guaranteed income in retirement. Small monthly contributions, matched by the government, translate into a fixed payout for life with household protection built in. If you’re eligible, starting early reduces your monthly burden, keeps you consistent, and locks in benefits that matter most when work slows down. Enroll at your nearest CSC or through the Maandhan portal, enable auto‑debit, and give your family the confidence of a pension that arrives every month without depending on markets or employers.

What Is PM-SYM?

Pradhan Mantri Shram Yogi Maandhan (PM-SYM) is a voluntary, contributory pension for unorganised workers that guarantees a non-market-linked ₹3,000 monthly pension after 60. The design is intentionally simple: contribute a fixed amount monthly based on your age at entry, the government contributes the same amount, and you receive an assured pension for life. The program’s architecture combines central administration with LIC-managed payouts and last‑mile enrollment support through CSCs, making it both credible and accessible to first-time pension savers.

Who Is Eligible for ₹3000 Monthly Pension?

To join, you must:

- Be 18–40 years old at enrollment.

- Earn up to ₹15,000 per month from unorganised sector work.

- Not be an income-tax assessee.

- Not be covered under EPF, ESIC, or NPS.

- Hold Aadhaar, a savings/Jan Dhan account with IFSC, and a mobile number.

These criteria avoid overlap with formal sector benefits and direct support to those most exposed to old-age income insecurity.

How The ₹3000 Pension Is Funded

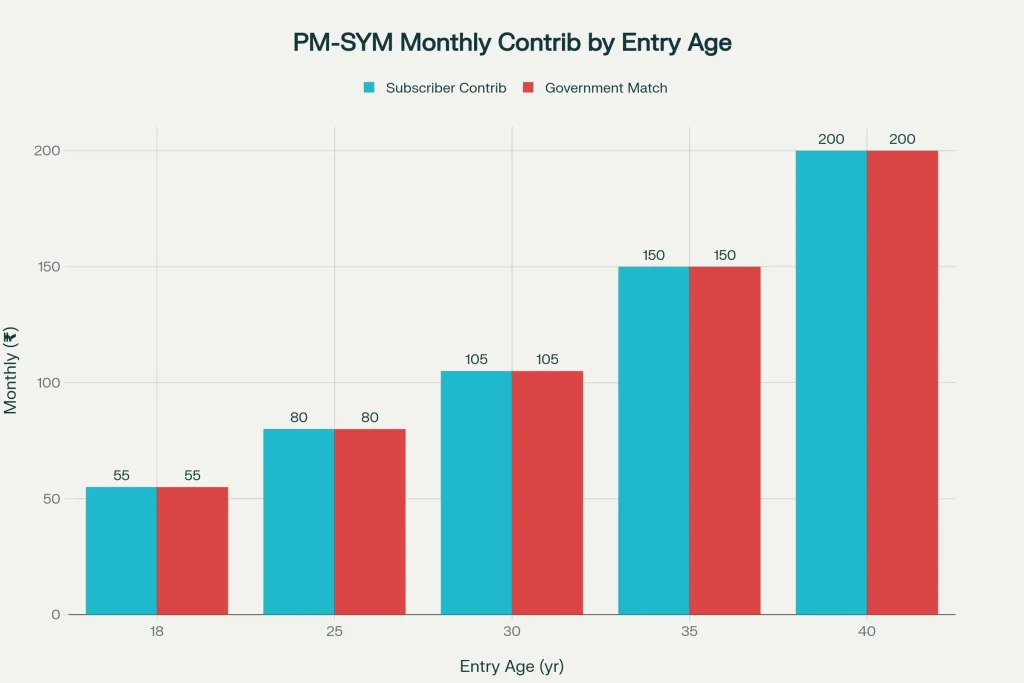

The contribution is age-linked and shared equally by the subscriber and the Centre:

- Join earlier, pay less per month across more years.

- Join later (closer to 40), pay more per month for fewer years.

Representative monthly contribution guide: - Entry at 18: ~₹55 by worker + ₹55 by Centre.

- Entry at 25: ~₹80 by worker + ₹80 by Centre.

- Entry at 30: ~₹105 by worker + ₹105 by Centre.

- Entry at 35: ~₹150 by worker + ₹150 by Centre.

- Entry at 40: ~₹200 by worker + ₹200 by Centre.

Contributions continue until you reach 60. From then on, you receive ₹3,000 per month for life.

Enrollment And Documents Required for ₹3000 Monthly Pension

You can enroll at a nearby CSC or online through the official Maandhan portal. Bring:

- Aadhaar for identity verification (biometric at CSCs).

- Savings/Jan Dhan account with IFSC for auto-debit and pension credit.

- Mobile number for OTPs and alerts.

At a CSC, the VLE will verify details, fill the form, take the first contribution, and set up monthly auto-debit. You’ll receive a PM‑SYM card as proof. If you prefer digital, self-enrollment takes a few minutes once your documents are ready.

Family Pension and Household Security

The family pension is a core protection. If the subscriber dies after pension commencement, the spouse is entitled to 50% of the assured pension (₹1,500 per month). Before vesting, in case of death or disability, the spouse can either continue the contributions and stay on track for future pension or withdraw contributions with applicable interest as per rules. This ensures that savings don’t vanish at the worst possible time and that households maintain a basic income floor.

Exits, Revival, And Flexibility

Recognising the reality of irregular incomes, the scheme includes:

- Exit before 10 years: Refund of subscriber’s contributions with savings bank interest.

- Exit after 10 years but before 60: Refund of subscriber’s share with actual fund interest or savings bank interest, whichever is higher.

- Death or permanent disability before 60: Spouse may continue the plan or exit with contributions plus applicable interest.

- Death after 60: Spouse receives 50% family pension; upon spouse’s demise, corpus handling follows scheme rules.

- Revival: If your account turns dormant due to missed payments, you can regularise dues within an extended revival window (up to three years).

- Service features: Account statements and claim status tracking support transparency and ease of use.

Why The Scheme Matters Now

For crores of Indians outside the formal safety net, retirement planning usually competes with daily expenses. The ₹3000 monthly pension scheme for workers provides certainty with a defined, non-market-linked benefit. Government matching effectively doubles the value of every rupee contributed during accumulation. Spousal coverage reduces household risk. And the administrative plumbing CSCs for access, the fund manager for payouts helps the scheme reach and sustain scale. Integration with e‑Shram data and targeted outreach further improves discovery and reactivation, reducing friction at the margins.

How To Get Started Today

- Confirm eligibility: Age 18–40, income ≤ ₹15,000, not a taxpayer, and not covered by EPF/ESIC/NPS.

- Prepare documents: Aadhaar, bank account (with IFSC), mobile number, and basic personal details.

- Choose your channel: Visit a CSC for assisted enrollment or use the Maandhan portal for self‑registration.

- Set contributions: The system calculates your exact monthly amount based on entry age; starting early minimizes the monthly outgo.

- Enable auto‑debit: Keep payments regular to avoid lapses; if you miss some, use the revival window to catch up.

- Inform your spouse: Make sure they understand how family pension works and where the documents are kept.

- Keep records: Save the PM‑SYM card, enrollment receipt, and SMS confirmations; check statements periodically.

Who Should Join Early

- Workers under 30: Lowest monthly contribution with the longest compounding runway.

- Single‑income families: Built-in family pension is a meaningful hedge.

- Seasonal or gig workers: Auto-debit plus revival features reduce the risk of permanent lapses.

- Women in informal roles: Provides a personal retirement buffer independent of employer coverage.

Aadhaar Card New Rules — Update Your Name and Address Online for Free, Here’s How

Common Misconceptions

- “I can’t afford monthly contributions.” Entry-age contributions are intentionally small. Starting young spreads the cost and locks in benefits.

- “Markets are risky; I might lose money.” The pension is assured at ₹3,000 per month after 60 it’s not tied to market ups and downs.

- “It’s too technical.” CSC operators are trained to help with Aadhaar verification, bank details, and setup. The portal option is there for those comfortable with digital onboarding.

- “My savings account is enough.” A savings account doesn’t guarantee a lifelong monthly pension; PM‑SYM formalises a fixed, post-60 income stream with government support.

FAQs on ₹3000 Monthly Pension Approved

Can I join if I already have EPF or NPS?

No. PM‑SYM is for unorganised workers not covered by EPF, ESIC, or NPS and who are not income-tax assesses.

What happens if I stop paying for a while?

Your account can be revived within the extended window by paying pending dues. Auto‑debit helps avoid gaps; if income is irregular, plan contributions around inflow cycles.

Does my spouse automatically get benefits?

After pension starts, your spouse is eligible for 50% family pension on the subscriber’s demise. Before vesting, the spouse can continue the plan or exit with the subscriber’s contributions plus applicable interest.

How much do I need to contribute monthly?

It depends on your age at entry roughly ₹55 at 18, rising gradually up to about ₹200 at 40, with the government matching the same amount every month until you turn 60.