Sukanya Samriddhi Yojana is a smart, government-backed way to build a long-term, tax-free fund for your daughter with steady, guaranteed compounding and a current interest rate of 8.2% per annum. The idea of starting small like ₹250 monthly appeals to many parents, but the headline claim of turning that into ₹74 lakh needs context so you plan with realistic numbers and clear expectations.

Sukanya Samriddhi Yojana is designed for the girl child’s future, with deposits allowed up to 15 years and maturity after 21 years from account opening, and it currently earns 8.2% per annum compounded annually. You can contribute in flexible instalments, keep the account active with a low minimum, and enjoy full tax exemption on interest and maturity alongside Section 80C benefits up to ₹1.5 lakh a year.

₹250 Monthly in Post Office SSY Scheme

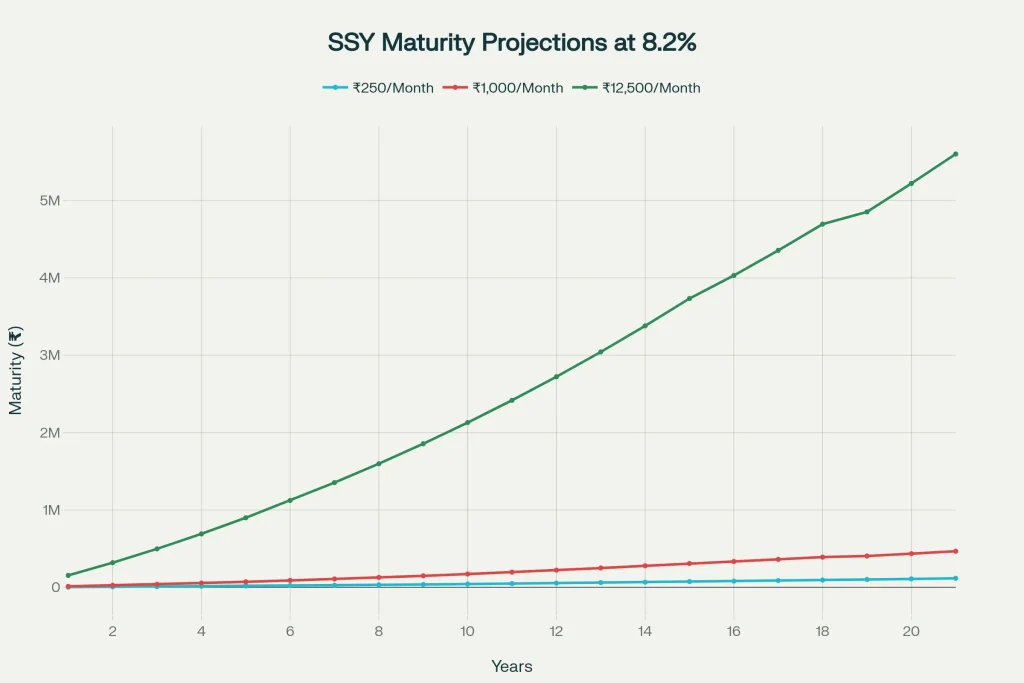

Deposit just ₹250 monthly in Sukanya Samriddhi Yojana if you’re starting out, but scale contributions steadily if your target is a sizeable education or marriage fund, because returns track your principal and time in the scheme. Treat the ₹74 lakh headline as a reminder to plan ambitiously and use calculators to map a contribution plan closer to the annual cap for 15 years, letting 8.2% compounding do the rest until year 21.

What The ₹74 Lakh Claim Really Means

Let’s address the big promise straight: ₹250 per month is not going to compound into ₹74 lakh in SSY under the current structure and rates; that corpus band typically appears when contributions are much closer to the annual cap over the 15 deposit years. SSY rewards consistency and higher principal so if your target is ₹50–₹75 lakh, you’ll need to model contributions near the ₹1.5 lakh yearly limit, then let the corpus compound until year 21.

Why SSY Still Deserves A Place

Even without sensational projections, Sukanya Samriddhi Yojana ticks the boxes parents care about: sovereign safety, a high administered rate for a small-savings scheme, and full tax exemption on interest and maturity. The discipline of a 15-year contribution window followed by continued compounding until the 21-year maturity helps you stay on track for education or marriage goals.

How Contributions and Time Drive Outcomes

SSY compounds annually, so your interest is added to the balance each year and earns more interest in subsequent years. The two levers you control are contribution size and time in the scheme; starting early and contributing more meaningfully are what create a large maturity value.

Post Office SSY Scheme Eligibility Criteria, Account Opening, And Flexibility

You can open an SSY account for a girl child below 10 at a Post Office or authorised bank, with one account per girl and up to two per family, with limited exceptions. Deposits can be made in multiple instalments or lump sum in a year, provided you meet at least the minimum to keep the account active.

Interest Rate Updates and Planning

The current rate is 8.2% for the latest notified quarter, and rates are reviewed periodically, so plan with today’s number and revisit annually. Using this current rate in your planning models keeps projections grounded and prevents overestimation of the final corpus.

Using Calculators to Set Realistic Targets

Before finalizing your monthly budget, plug scenarios into reputable SSY calculators to compare ₹250 monthly with ₹1,000 monthly or higher annual lump sums up to ₹1.5 lakh. This will make the maturity gap visible and help you choose a contribution level that aligns with education timelines and target corpus.

Tax Benefits That Improve Effective Returns

SSY enjoys EEE status investments qualify for Section 80C, and both interest and maturity are tax-free which boosts your effective, post-tax return versus comparable taxable instruments. For families with tax liability, allocating part of the 80C limit to SSY can be a highly efficient move.

Practical Planning Tips For Parents

- Start Early: Opening the account soon after birth maximizes compounding to the 21-year mark.

- Contribute With Intent: If the goal is a multi‑lakh corpus, aim well above the minimum; consistency across 15 years matters.

- Align Withdrawals: Consider the 50% educational withdrawal after 18 to time tuition needs while keeping the rest compounding.

- Review Annually: Recheck the notified rate each year and adjust contributions if your target corpus has shifted.

Common Mistakes To Avoid

- Misreading The Minimum: ₹250 is the minimum per financial year to keep the account active, not a magic path to crores.

- Ignoring The Cap: Returns scale with principal; if you can afford to go closer to ₹1.5 lakh a year, your maturity jumps meaningfully.

- Waiting Too Long: Delaying account opening reduces total compounding years and shrinks the final corpus.

SSY Versus Other Safe Options

Compared to many bank FDs and other small savings options, SSY’s combination of a competitive administered rate with full tax exemption makes it stand out for long-term, goal-based planning. You’re trading market volatility for guaranteed sovereign-backed compounding tailored to a specific life goal.