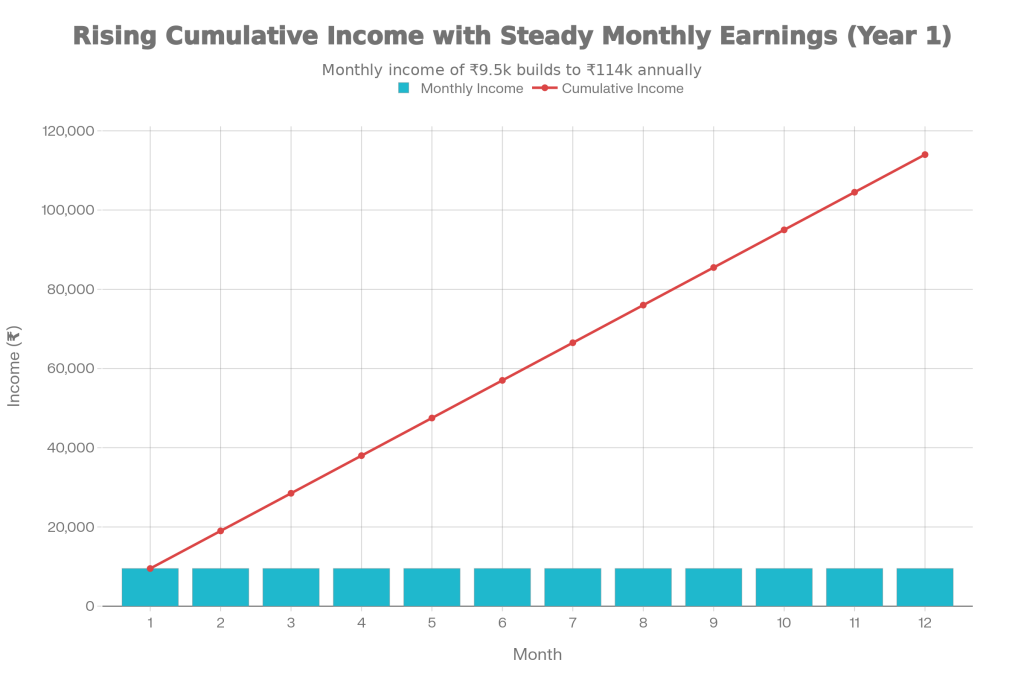

When you’re trying to build a steady side income, the idea of a simple one-time deposit sounds comforting and that’s exactly why the LIC Guaranteed Income Plan 2025 keeps getting searched right now. The promise of predictable monthly money is what pulls most people in, especially if you don’t want to track markets every day. If you’ve been looking for a low-stress monthly payout option… or many families, stability has become the new smart return and that’s where the LIC Guaranteed Income Plan 2025 comes into the picture again and again. In simple terms, it’s being discussed as a fixed monthly income style option where you invest once and receive a planned payout every month. It’s not meant to be fancy it’s meant to be dependable.

If you like investments that feel predictable, this plan is being positioned as a one-time deposit style income setup where payouts are fixed as per terms. The biggest reason people look at such options is simple cash flow. Rent, groceries, school fees, medicines these are monthly needs, so a monthly payout feels practical. Also, when returns are described as stable and not market-linked, it becomes easier to plan your household budget. That’s why many conservative investors, retirees, and even homemakers are curious about this kind of plan. The key is not to treat it like a get rich quick product. Think of it as a structured income tool.

₹1.5 Lakh Investment Income Plan

| Feature | Details |

|---|---|

| Scheme Name | LIC Monthly Income Plan style option |

| One-time Investment | ₹1,50,000 |

| Claimed Monthly Income | Around ₹9,500 per month |

| Income Frequency | Monthly |

| Return Type | Fixed and predictable |

| Market Linkage | Not market-linked |

| Risk Level | Low risk (as positioned) |

| Best For | Retirees, homemakers, conservative investors |

| Application Mode | LIC branch / authorized online channels |

| Tax Note | Monthly income is taxable as per rules |

| Primary Benefit | Regular monthly cash flow |

How The Lic Monthly Income Structure Functions

The working idea is straightforward. You deposit a lump sum amount once, and in return you receive a monthly payout based on the plan’s payout structure and tenure conditions. People like these plans because the payout is designed to be regular and easy to understand.

From a practical angle, this structure helps in two situations:

- When you want income without managing a business or side hustle.

- When you want predictable money every month instead of uncertain market-linked gains.

One important mindset shift: monthly income plans are mainly for stability. If the goal is aggressive wealth creation, then market instruments usually fit better. But if the goal is steady monthly inflow, plans like this are designed exactly for that.

Why Stability Matters More Than High Returns

A lot of people chase higher returns and there’s nothing wrong with that. But higher return usually comes with higher uncertainty. If the priority is calm, predictable income, then stability matters more than squeezing out the last extra percentage. This is exactly the psychology behind monthly income plans. They’re not built to beat the market. They’re built to reduce anxiety.

In 2026, many households are balancing multiple responsibilities:

- Home loans or rent

- Education expenses

- Rising medical costs

- Uncertain job markets in some sectors

In that context, a known monthly payout can feel more valuable than a risky return that looks good only on paper.

Trust And Security Backed By LIC

For many Indians, LIC is not just a brand it’s an institution they’ve heard about since childhood. That trust matters a lot when you’re investing for income. People often prefer a familiar, reputed name for long-term commitments, especially when the product is meant for safety and stability.

That said, trust should never replace verification. Before investing, it’s smart to confirm:

- The exact plan name and official brochure

- The payout amount and payout duration

- Any charges, conditions, or exclusions

- Whether the income is guaranteed or illustrated

When you’re investing for income, clarity is everything.

Flexibility of ₹1.5 Lakh Investment Income Plan

One reason these plans attract attention is that they’re not only for retirees. A working professional might want an additional monthly inflow. A homemaker may want a stable household support payout. Someone planning early retirement might want predictable income to reduce dependence on savings.

Depending on the exact policy design, such income plans may offer different tenure or payout structures. That’s why it’s important to choose based on your timeline, not just the monthly figure.

A simple way to think about it:

- Short-to-medium horizon: Useful when you want support for a defined period.

- Longer horizon: Useful when you want ongoing income planning.

The plan should match your life stage, not just your curiosity.

Easy Enrollment And Simple Process for ₹1.5 Lakh Investment Income Plan

These plans are usually promoted as easy to start, because the process is designed for mass adoption. Typically, you can explore it through:

- Visiting a nearby LIC branch

- Speaking to an authorized agent

- Using official/authorized online channels where available

To keep things smooth, it helps to keep these ready:

- Identity proof

- Address proof

- PAN card (important for taxation and KYC)

- Bank details for payout credit

Always insist on reading the official benefit illustration or policy document. Don’t invest based on a single screenshot, viral post, or forwarded message.

Tax Implications And Financial Planning Perspective

This point is crucial: monthly income is generally taxable as per your slab and applicable rules. Many people look only at “₹9,500 per month” and forget to ask, how much will be left after tax?

So, while evaluating, ask yourself:

- What is your current tax slab?

- Will this monthly income push you into a higher slab?

- Do you need this payout now, or can you grow money and withdraw later?

If you want an income plan mainly for monthly expenses, taxation might still be okay because your goal is cash flow. But if your goal is maximum return, taxes can reduce the effective benefit.

A smart move is to compare the post-tax monthly income with alternatives like:

- Bank FD monthly interest payout

- Post Office monthly income style schemes

- Annuity-based pension products

- Debt mutual fund SWP (systematic withdrawal plan) for some profiles

A Dependable Income Stream For Retirement

Retirement planning is not only about how much corpus you have. It’s also about how smoothly you can convert that corpus into monthly income without stress.

That’s why income plans are popular among retirees. The routine payout can help cover:

- Household expenses

- Medical bills

- Utility payments

- Small lifestyle costs

If someone already receives pension, a monthly payout plan can act as a supplement. If there is no pension, then this kind of structured payout can feel like a self-made pension style income. Still, retirees should be extra careful about liquidity. Before investing a lump sum, confirm whether partial withdrawal, surrender options, or emergency access exists and what the penalties are.

Benefits Beyond Retirement Years

Even if retirement is the most common use case, monthly income planning is useful beyond it. Some families use such plans for:

- Supporting parents with a fixed monthly amount

- Creating a separate household expense payout

- Building a backup income stream

The biggest benefit is emotional: when money arrives monthly, it feels like support, not like slowly draining savings.

But the best way to use such a plan is as part of a bigger strategy, not the only strategy. A balanced plan might include:

- Emergency fund for sudden needs

- Growth investments for long-term wealth

- Stable income instruments for routine cash flow

This mix reduces the pressure on any single product.

LIC Monthly Income Plan 2025 Key Details

Here are the key points people usually track before deciding:

- One-time investment amount and minimum requirement

- Claimed monthly income figure and how it’s calculated

- Payout start time and payout duration

- Whether payout is guaranteed or depends on terms

- Lock-in and surrender conditions

- Taxation on payout

- Nominee and death benefit terms.

This is also where many people make mistakes by assuming monthly income means profit. In reality, some income plans include components of your own principal being paid back along with returns, depending on design. That’s why reading the policy illustration matters.

PM Kisan Yojana Update 2025 – ₹6,000 or ₹12,000? Government Clears the Confusion for Farmers

Transparency That Encourages Informed Decisions

When you invest for monthly income, transparency is everything. The right plan is the one you understand fully. The wrong plan is the one you bought because it sounded viral.

Before you commit, ask these direct questions:

- Is ₹9,500 per month fixed for the full tenure?

- What tenure is assumed for that payout figure?

- Are there any conditions that can change the payout?

- What happens at maturity?

- What happens if you need money in between?

If the goal is predictable monthly cash flow with a low-risk mindset, this type of monthly income plan can be worth exploring. It’s especially attractive for people who want routine income and don’t want market volatility. But the decision should be based on official terms, not only headline monthly figures. The best approach is to verify the plan from official sources, check the written illustration, calculate post-tax income, and then decide whether it fits your needs and timeline. This blog post is for informational purposes only. Investment features, payouts, and tax rules can change, and actual benefits depend on official policy terms. Always read the official document carefully or consult a qualified advisor before investing.

FAQs on ₹1.5 Lakh Investment Income Plan

Is The LIC Guaranteed Income Plan 2025 Market Linked

It is generally promoted as not market-linked, meaning payouts are positioned as stable rather than dependent on market performance.

Is The Monthly Income Really Around ₹9,500

The ₹9,500 figure is typically presented as an approximate payout based on stated terms and conditions. The exact amount can vary based on the specific plan variant and tenure assumptions.

Is The Monthly Payout Taxable

Yes, monthly payouts are usually taxable as per income tax rules applicable to your slab. Always confirm current tax treatment before investing.

Who Should Consider This Type of Monthly Income Plan

It may suit retirees, homemakers, and conservative investors who value predictable income over high-risk returns and want easier monthly budgeting.